I generally avoid writing about any airline until they complete about a year in Indian skies. However Vistara was different, I first wrote about them even before they started their operations. (Is Vistara’s rumored seating configuration the right mix?) The article has been relevant every day since then and more so in current times when the airline debates and decides on the change in seating configuration.

In October 2015 I wrote Vistara shifts gears – reworks network, starts lobbying in which I said, “.. the airline probably needs a senior strategy team with experience in handling the complex Indian market..”.

Interestingly, the airline announced appointment of Mr. Sanjeev Kapoor who led the turnaround of Spicejet as its Chief Strategy Officer. Mr. Kapoor is slated to take charge soon.

The airline currently operates with a fleet of 9 A320 aircraft and flies to 12 destinations. A look at the current network, sectors, utilization of Vistara and what lays ahead for the airline.

Flashback

The TATA-SIA joint venture took to the skies in January 2015 after securing the Air Operating Permit (AOP). The airline ordered 20 Airbus A320 aircraft of which it has taken delivery of 09 aircraft till date and the next were to be expected at the beginning of Summer Schedule of 2016.

The airline announced Delhi as its main hub and today bases all but one aircraft at Delhi. Launching with services between Delhi – Mumbai, Mumbai – Ahmedabad and Delhi – Ahmedabad, the airline quickly expanded to other cities.

While the airline got exemption from the government for fulfillment on Route Dispersal Guidelines for a limited period, the airline was quick to launch services on Delhi – Guwahati – Bagdogra – Delhi sector to fulfill the mandatory Available Seat Kilo meters (ASKM) quota.

Vistara, initially was selling tickets for only point to point services or what is known as O-D (Origin – Destination) and later started offering one-stop pricing with connections via Delhi to Lucknow and Varanasi.

Current market reach & Schedule

The airline operates to top seven of ten routes from Delhi. The only sectors which it does not are Kolkata, Chennai & Srinagar. The airline seems to have chosen an approach of strengthening a hub first before moving on and connecting other destinations with itself. This strategy is not one of the most popular ones. While there are arguments and counter arguments for both, fortifying one station before venturing out to another helps a lot in Sales.

Selling airline seats is a multi-pronged game. It is way different than the seemingly simple direct website sales & Online Travel Agents (OTAs). The real battle is with pushing seats in the market with travel agents, group bookings and corporates.

Hence, it makes sense to be solid in one market than become the path of least resistance in all markets and increase the selling & distribution costs which are disproportionate to the market reach that is being offered.

With the current schedule being in favor of a traveler based in Delhi, for all routes except Mumbai, the majority focus of sales, if not entire can be on Delhi market and even the return tickets being driven from the same market.

I do not have the data for “Point of Sale” for the airline, but I believe the proportion is high.

Key Parameters

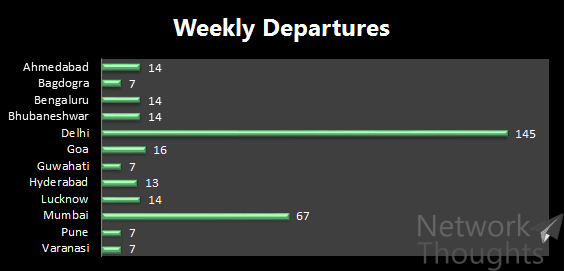

The airline which has 325 weekly departures has a lot of scope for improvement.

Vistara currently has 5.2 flights per aircraft on average and 10:06 hours of utilization per aircraft. The utilization is lower on account of two of its aircraft being idle during the afternoon hours. Four out of nine aircraft of the airline are spending more than 11:00 hours in the air, which is a good number with only domestic flying. It is only in the past one and half year that Jet Airways crosses 12:00 hours of utilization and the airline has heavy international presence with its narrow bodies.

Delhi, where all but one of the aircraft are parked, clearly leads the charts for weekly departures.

Future

Immediate

The airline has come close to the upper limit of its mandatory ASKM deployment on Category II-A routes. It deployed 1.08% of its category I ASKMs, just 0.08% above the mandatory 1%. This means that the airline will have to start additional services on the Bagdogra – Guwahati sector, where it currently serves one way or start new stations. The options could narrow down to starting Imphal or Dibrugarh with one stop flights via Guwahati to strengthen Guwahati or start Srinagar & Jammu and continue focus on its main hub of New Delhi.

The airline has acknowledged that it would go ahead with the re-configuration. However, it has not announced the revised configuration.

Also on agenda for the airline should be to tackle the pricing issues of Economy & Premium Economy. There have been umpteen instances where the Premium Economy seats were available for a fare lower than the Economy class.

I see this being addressed by pegging the Premium Economy class fare to Economy class, which will also reduce work for the employees and make the offering more attractive. Currently the difference in offering in terms of food is not being communicated properly to the market.

Intermediate

Vistara was to roll out in-flight Wi-Fi services by December 2015, a deadline which it has missed. The airline apparently is still working with its vendors and authorities for the approval. With only Air India providing personalized screens in domestic market and the content not being up to date, the airline has so far not had problems competing. However, with Jet Airways announcing its intention of offering Wi-Fi services, Vistara will surely lose out on the long run it would have got with the first mover advantage.

Sadly the airline does not intend to provide charging points, which could limit usage of the Wi-Fi services.

On the network side, the airline will continue to expand with possibility of basing more aircraft in Mumbai and adding Bengaluru as its next base.

Long term

Ratan Tata recently wrote an open letter for withdrawal of the 5/20 rule. The pressure would surely build up on the government to make changes. While the lobbying by Tata’s would help both the airlines they have invested in be eligible for flying international, even Singapore airlines would want the government to act on abolishment of this rule.

If and when the 5/20 rules will make way, Vistara could order or lease wide body aircraft to start services from Delhi – its primary hub to major destinations. In Indian skies, the removal of 5/20 is only half the battle, the other half is allocation of bilateral rights which are also controlled by the Ministry & Government.

Tail note

The airline seems to have charted out a course for itself and is not dependent on what the competition is doing. Like Air Asia, which has seen network mirroring by competition, Vistara has also seen competition react with additional frequencies and offers for redemption of frequent flier miles or at times even enhanced accruals for certain class of travel.

Will the airline be better off going after Air India than Jet Airways on the domestic sector? Is the airline happy flying to the dense routes ex-Delhi and get small slice of a pie rather than expand the pie? Will the airline be aggressive in the market or look for steady growth? These are questions which time will tell, but I feel the airline is here for the long run.