Air traffic in India continued to grow at breakneck speed as 66.66 lakh passengers flew in September’15, revealed the data released by Indian Directorate General of Civil Aviation (DGCA) on 20th October’15.

The YoY growth from January to September has been 20.1% with 590.21 lakh passengers having flown in 2015 as compared to 491.44 lakh passengers for the same period last year.

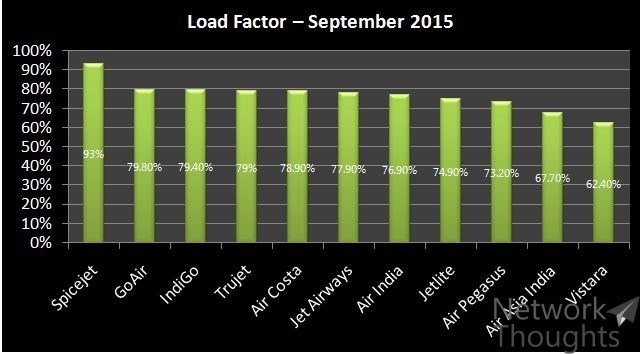

Load Factor

Spicejet continued to have least empty seats on its flights with a load factor of 93%. It is the fifth consecutive month when the airline is carrying over 90% loads on its flights. The next best was Go Air which had a load factor of 79.8%. Market leader IndiGo recorded 79.4% load factor. Full Service carrier Vistara continued to struggle having the lowest load factor of 62.4% for the month of September’15 while Air Asia India was the other carrier which slipped back to the 60s having a load factor of 67.7%, its lowest in 2015.

On Time Performance

Vistara was leading the pack in On Time Performance (OTP) with 94.2%. However, IndiGo has made a solid comeback on the OTP front with massive improvements recording 91.2% and highest among pan-India players. Air Pegasus – which has been struggling off late, seeing cancellations and recorded highest cancellations also recorded the lowest OTP of 66.9%. Among pan-India carriers, it was Air India which recorded the lowest OTP of 82.4%. Spicejet, which had been clocking lower OTP in the early part of the year has stabilised with 85.1% flights being on time. Most notable improvement in OTP came from National Carrier Air India which bettered its OTP by 7.2% over last September.

While Mumbai has been struggling to accommodate the additional traffic due to this boom in Indian Aviation, Delhi airport seems to have done a fantastic job with an overall OTP of over 90% as an airport. All carriers saw tremendous improvement in OTP at Delhi over the previous year even as domestic departures grew 17% YoY.

Market Share

After losing market share for three months, IndiGo gained over a percent over previous month to continue as a market leader with 36.5% market share. The airline carried 24.30 lakh passengers in September’15 which was 27% more than last year. Air India, Jet Airways and Air Asia saw a drop in market share over last month, while Spicejet Air Costa, Pegasus and Trujet remained flat. Go Air gained market share on expected lines as it re-started some of its flights which were cancelled in August and some part of September.

On a year on year basis, IndiGo has gained 3.7% market share while Spicejet has lost 6.3% share due to its lower capacity. The airline could have lost even more had it not been for its revenue management techniques which have resulted in higher loads.

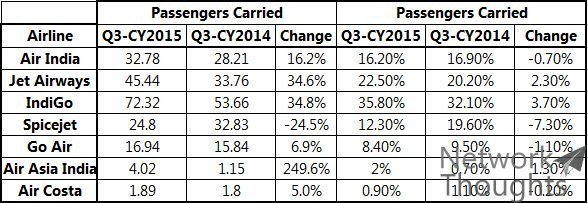

Quarterly Summary

A traditionally lean quarter has turned out to be one clocking 20% growth over last year. Airlines carried 201.88 lakh passengers in Q3-CY15 as compared to 167.35 lakh in Q3-CY14. Interesting to note that the passengers carried in this lean quarter were more than even the number of the best quarter last year.

While a year on year comparison shows highest market share growth by IndiGo at 3.7% followed by Jet Airways at 2.3%, both the airlines recorded a 34% jump in passengers carried in Q3-CY15 over Q3-CY14.

Air India which saw a decline in market share, carried 16% more traffic than last year while Go Air and Air Costa carried 6% and 5% more respectively. Air Asia sees a growth of over 300% thanks to its doubling of capacity and lower base for the calculation last year.

Key Points

- Domestic departures up 17% in Delhi and 14% in Mumbai

- 35% of domestic departures in Mumbai are by Jet Airways while 31% by IndiGo

- In Delhi, 33% of all domestic departures are by IndiGo while 24% by Jet Airways

- 61% of passengers flew Low Cost Carriers in September, it was 63% in September’14

- While passengers grew 27% for IndiGo, its departures grew only by 22%

- Jet Airways saw an increase in departures by 13% but passengers grew by 20%

Outlook

There was negligible capacity growth in Indian skies in October. As winter schedule kicks in from 25th October, most of the airlines have made minor changes to their network which is expected to work in their favour. However the changes will affect the market share and loads only in November, which also happens to be a month of festivities which traditionally sees higher loads.

October could see flat growth from IndiGo, Spicejet, Air Asia and Jet Airways. Vistara and Go Air could see marginal increase in market share. While Air India and Air Costa could see a marginal drop in market share. October will be another month which will most likely be lead by Spicejet on the Load Factor charts, followed closely by Jet Airways and IndiGo.

The last quarter of the calendar year looks promising than ever before for airlines in India.