Impressive growth continues for Indian Aviation with 78.72 lakh passengers taking to air travel in March 2016. This was a growth of 24.03% YoY and 25.25% MoM. The Quarter on Quarter (QoQ) growth was also 24%. For the period from January to March, 230.03 lakh passengers travelled by air, 44.57 lakh more than the same period last year.

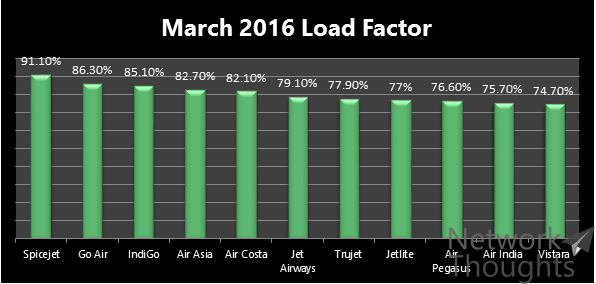

All airlines except Vistara saw a decrease in Load Factors over the previous month, while all major carriers except Jet Airways performed better than March 2015. After months of good performance, Jet Airways saw a decrease in market share, load factor as well as On Time Performance (OTP) as compared to the same period last year.

While the load factors decreased over February, the passenger numbers increased for all major carriers. Jet Airways and Air Costa carried fewer passengers than the same month last year. While Air Costa saw a decrease in capacity, Jet Airways has been boasting about increase in capacity deployed without any increase in fleet size.

Air Asia & Vistara recorded 0 cancellations during the month while Air Pegasus reported maximum, 40% of its flights were cancelled. The three aircraft airline based in Bengaluru has been resorting to a lot of cancellation for the past few months. The airline also had the maximum passenger complaints.

With Vistara starting flights to Srinagar & Jammu, the Cat IIA ASKM deployment for the airline will go up further, giving it more room to start flights on metro routes. The airline is expected to announce launch of services to Kolkata when the new aircraft arrives.

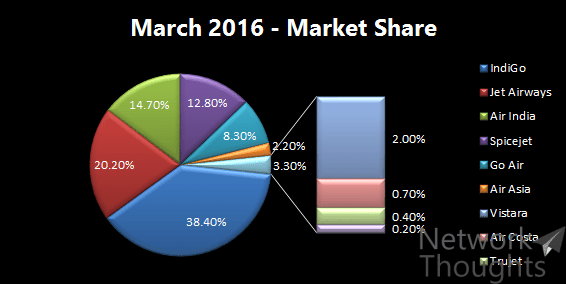

Market share numbers are taking interesting turn with IndiGo seeing a growth of over one and half percent from February on the back of additional capacity deployed. The lead has been further extended since Jet Airways did not perform very well in March. Spicejet, Air Asia & Vistara gained market share over the last year.

Air Asia & Vistara have doubled their Departures, Passengers and ASKM over last March.

Low Cost Carriers carried 63% of all passengers in March, while the number stood at 61% for Q1. March saw 58% of all departures by Low Cost Carries, up from 54% in February.

What to expect next month & quarter?

IndiGo has been going easy on the induction of A320neo due to the ongoing issues. If the issues are resolved soon, the airline will see a spate of inductions. Go Air growth plan will also be dependent on A320neo. Will IndiGo get to the elusive 40% market share is something which time will tell.

Vistara will see minimal increase in capacity as it inducts new aircraft.

Tail Note

The regular monthly updates will take a break from next month. This will be the last in the series. There are certain reasons for the same. The blog will also have lesser posts on Indian aviation & airlines and that would be compensated with posts related to a mix of technology & aviation starting with something interesting next week.

On the positive side, I plan to make the posts at specific intervals.